Perhaps when you invest or trade Forex, Gold, especially Indices you will often hear people mention DowJones. So what is DowJones? Find out below

What is Dow Jones?

Dow Jones, also known a Industrial Average, is one of most important stock indexes of US stock market. It not only reflects overall situation o US economy but also becomes an investment that many Index traders are interested in.

Dow Jones is made up of 30 stock indexes listed on New York Stock Exchange and Nasdaq. That are 30 companies on this list belong to different fields of activity: finance, consumer, technology, etc. This list is not fixed and can change depending on standards of meeting companies.

How to calculate Dow Jones index?

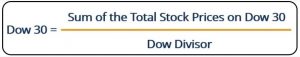

Formula for calculating Dow Jones is quite simple as its name suggests. Dow Jones is equal to total index value of the stocks on list divided by number of shares.

However, during calculation, there will be cases that mak index value change while stock price remains unchanged such as: splitting and merging of shareholders in companies, issuing new shares, transferring shares , … To avoid this problem and that Dow Jones can accurately reflect overall stock market reality , one will use a divisor to replace number of stocks in formula .

This divisor will change when there are fluctuations related to stock splits in companies. As below is an example of Calculation of the Dow 30.

Importance of Dow Jones index

Along with 2 indexes S&P 500 and Nasdaq, Dow Jones is one of 3 most important indexes of stock market in particular and US economy in general. Although Dow Jones was only developed from shares of 30 companies, these are largest and leading companies in country. Companies in Dow Jones list operate in all fields, not focusing much on one industry, so DJIA partly reflects overview of US economy.

Impacts from economic events, political events, natural disasters, inflation, unemployment… all affect Dow Jones. From there, we can see relationship between DJIA and events, political economy is a 2-way impact, a change from one side will affect other side.

Analysis of Dow Jones index is an essential thing for investors in financial sector because it has a great influence on trading psychology of majority of market, so understanding fluctuations of Dow Jones will It helps you to predict trend of market.

Despite being such an important thing, DJIA also has certain inadequacies. Because only 30 companies are included, this index sometimes does not represent overall economy.

Ways to Invest in Dow Jones Index

Currently there are 2 popular ways to invest in this index: through stock market and Forex. In which, investing in this index in stock market is only for investors in US because this is index of this country’s exchange.

In addition to traditional type of investment through underlying securities, there are many investment forms in derivatives market for investors: futures contracts, options contracts, contracts for difference, etc.

Dow Jones Futures is name of futures product from Dow Jones market index. With leverage provided, Dow Futures offers investors more profitable opportunities than buying spot stocks.

Options contracts with symbol DJX issued by Chicago Board Options Exchange are most popular option for people to invest in.

Besides, ETFs like Dow Diamonds, Dow 30,.. are also popular forms of investment in this index.

Conclude

Dow Jones index not only reflects US stock market, but it also paints overall picture of world economy. Therefore, it is one of most interested indicators in financial markets. We hope that through this article, you have gained enough knowledge about Dow Jones index.

You may be interested in: