Perhaps in some parts of Asia, Exness will certainly be first name mentioned. To be precise, Exness really understands psychology of traders, so it gives them exactly what they want and need. Therefore, although there are many brokers that are superior to Exness, and really still number 1 name, having upper hand, perfect choice for novice traders. So what does Exness have? Let’s find out with broker Exness review below.

Frequently asked questions about Exness

Exness broker overview

Exness is a fairly old company, has been operating for 12 years, since its founding in 2008, in St. Petersburg, Russia, by “a group of like-minded professionals in fields of finance and information technology”.

However, for Exness to be “famous” as it is today, it must be mentioned that Exness moved its headquarters from Russia to Europe. This has resulted in a breakout growth that has made Exness largest retail forex broker in the world. According to a report from Exness itself, “as of December 2019, monthly client trading volume reached $325.8 billion and our number of active traders around the world exceeded 72,721 .”

Exness broker is serving clients from different countries around the world. As you can see, Exness has now added 15 languages on its website and with offices located in many places, not to mention the 2 main offices located in Saint Vincent and Grenadines. In addition to above information, Exness is really a strong financial group with many branches, including Nymstar Limited securities company. This means that Exness is not only developing strongly in foreign exchange market, but also expanding its influence to other fields such as securities here.

Some basic information about Exness:

- Year of establishment: 2008

- Headquarters: Limassol, Cyprus

- Maximum leverage: 1: unlimited

- Minimum deposit: $10

- Copy Trade: Yes, it’s called Social Trading Exness

- Deposit and withdrawal methods: Credit Card, Neteller, Skrill, Internet Banking, Bitcoin, Ngan Luong

- Exness Trading Products Offers: Currencies, Cryptocurrencies, Metals, Energy, Stock CFDs, ETFs

- Exness trading software supports: MT4, MT5 platform, Web Terminal

- Compatible Operating Systems: Windows and Mac Desktop Platforms, Web Platforms, Android and iOS

Exness has regulations and licenses from which organization?

This is something we pay close attention to to new traders. Please find a licensed broker to trade, to avoid maximum risk for your account. Reason for saying that is because when you deposit money into account. Therefore, with a reputable broker, they will make it difficult for you to withdraw money or lack liquidity, so withdrawal time usually lasts a long time.

With reputable financial management institutions, when a broker registers to operate, the liquidity of that broker will be most important factor for these agencies to agree to license or not.

Like FCA, for example, they will often require the exchange to have a separate account mechanism, to ensure that exchange does not use customer’s deposit for private or illegal activities.

Exness is one of a number of licensed forex brokers from leading financial regulators such as FCA and CySEC. In addition, Exness is also licensed by regulatory authorities from Spain, Italy, Sweden, Netherlands and Germany to be able to operate in these markets.

Furthermore, Exness is also a member of Investor Compensation Fund (ICF). This means that traders will receive a maximum compensation of “up to 20,000 EUR, or a claim of up to 90% for investors” should Exness encounter any problems.

Also, Exness is also a broker with a separate account mechanism, due to influence of FCA license. Exness customer deposits are stored at one of leading banks such as: Barclays bank, Baltikums bank and OCBC bank.

What types of trading accounts are offered by Exness?

Currently, Exness only offers 5 main account types: Cent Standard account, Standard account, Classic account and ECN account.

In particular, these account types are divided based on 2 software, MT4 and MT5 with 2 main types including: Standard account and Professional account.

- MT4 software for: Standard and Standard Cent and 3 professional accounts: Raw Spread, Pro and Zero.

- MT5 software for: Raw Spread, Pro and Zero.

Basically, Exness MT4 and MT5 account types will have a little difference regarding minimum deposit, leverage. And most especially, accounts using new MT5 software can trade CFDs or indices. However, there is no need to rush to open a real account, but you can still try exness demo account

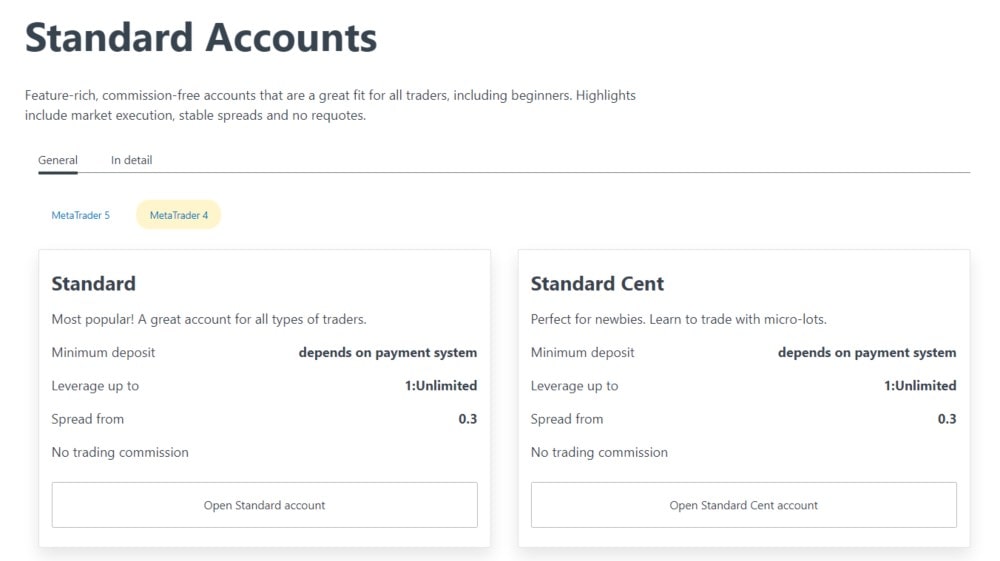

Standard account group

This is an account type designed by Exness for new traders or for those who want to test EAs or check brokers. Therefore, minimum deposit is extremely low of only 1 USD, with leverage up to infinity (for accounts that choose MT4 software) and 1:2000 (for accounts that choose MT5 software).

In standard account, there are two types of smaller accounts: Standard account and Standard Cent account.

These two types of accounts have many similarities, only slightly different in terms of deposits as well as trading products.

If Standard account money will be in USD, then Standard Cent account of Exness money will be in Cent. For example, if a customer deposits 10 USD, Standard Cent account will not show 10 USD, but 1000 Cent instead.

However, with Standard Cent account provided by Exness, you will be limited in terms of trading products, only being able to trade Forex currency pairs and Metals. If you want to trade cryptocurrencies, energies and indices, it is imperative that you open a Standard account.

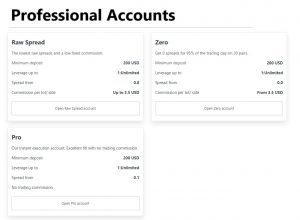

Professional account group

As name “professional”, Exness requires a minimum deposit of 200 USD or more, much higher than standard account. In addition, in each account type, there will be different specific rules for you to choose from.

Raw Spread account

- Minimum deposit: 200 USD

- Maximum leverage: 1:2000 (with account opened on MT5 platform) and 1: infinity (with account opened on MT4 platform).

- Commission Fee: fixed 7 USD/lot 2 way

- Spread from: 0.0 pips

Pro account

- Instant Execution Account. Quick order completion and no slippage.

- Minimum deposit: 200 USD

- Maximum leverage: 1:2000 (with account opened on MT5 platform) and 1: infinity (with account opened on MT4 platform).

- Spread from: 0.1 pips

- Trading Commission: No fee

Zero Account

- Enjoy zero spreads 95% of trading day for 30 pairs.

- Minimum deposit: 200 USD

- Maximum leverage: 1:2000 (with account opened on MT5 platform) and 1: infinity (with account opened on MT4 platform).

- Spread from:: 0.0

- Commission fee for 1 2-way lot from 7 USD, depending on type of trading product, there are different commission fees.

According to Exness regulations, Pro account has no commission, while Raw Spread account will have a fixed commission of 7 USD/lot 2 way. This means that all trading products have a fee of 7 USD. However, with Zero account type commission will start from 7 USD or more, especially for trading products like metals and rare currencies, commission fee can be 10 USD/lot 2 way.

Commission on Zero account is higher than on Raw Spread account, in return for extremely low spread on Zero account. Accordingly, traders will enjoy zero spreads on about 30 financial instruments 95% of time.

In contrast, Raw Spread account will have a spread of 0 pips or more, slightly higher than Zero account, and depending on product, Exness will set a different spread for Raw Spread.

Combining two account types above, Pro account will have highest spread from 0.1 pips or more, in return for this account Exness will not charge traders’ commissions when trading.

Of course, depending on purpose of use for you to make different choices. With a division like this, it can be seen that Exness almost meets all trading needs of traders from beginners to professional traders, as well as suitable for many different trading plans of traders. each person.

Spread, Commission and Leverage

Spreads provided by Exness

Exness offers extremely comfortable spreads, especially, with Zero Spread account type you can enjoy zero spreads for 30 different products in 95% of trading time. This is probably Exness’s strength when it comes to providing extremely competitive spreads that very few brokers can do like Exness at moment.

Commission fee provided by Exness

Commission fees are collected by Exness in 2 types of accounts: Zero Spread from 7 USD or more and Raw Spread up to 7 USD or more, fee will be higher depending on that product.

Leverage provided by Exness

They is also one of most reputable forex brokers with highest leverage today. For accounts using MT4 software, there will be 1: infinity. Meanwhile, trading account using MT5 software will be 1:2000.

Hit general psychology of traders and it is because of this attractive level of leverage that Exness has attracted a lot of traders of different ages to participate in trading.

You should note, although largest leverage that Exness offers is 1: infinity. However, depending on type of product with different deposit amounts, there will be different levels of leverage.

As a rule, if you deposit less than 1000 USD, you get 1:infinity leverage. If depositing from 1000 USD to 2999 USD, maximum leverage is only 1:2000. If depositing from 3000 USD to 9999 USD, leverage is only 1:1000.

This means, more you deposit, lower your leverage will be.

“Trade Bitcoin Exness” with no transaction fees

Yes! Bitcoin (BTC) trading is swap-free and this is just one of these free trading products, and you can find out details Exness has announced here.

Is Exness reputable? Pros and Cons

General information about Exness we have summarized above. Below, will be advantages and disadvantages of Exness, which any forex broker has.

Pros

- Registration process is quick and simple.

- Withdrawal is super fast only 3-5 minutes, especially Exness allows withdrawing both Saturday and Sunday, something that not all reputable forex brokers can do.

- Super good spread, more than 30 products with zero spread 95% of the time.

- Low deposit from 1 USD or more

- Multi-language support, up to 15 languages

Cons

- When news is out, the spread is still stretched.

- Standard Cent account does not support multiple trading products

You may be interested in:

Exness, nếu có tài khoản stoplevel=0 thì tuyệt hơn